The insurance portion of pension consists of two components: first and second insurance portions

In our previous material, we found out the pension calculation formula:

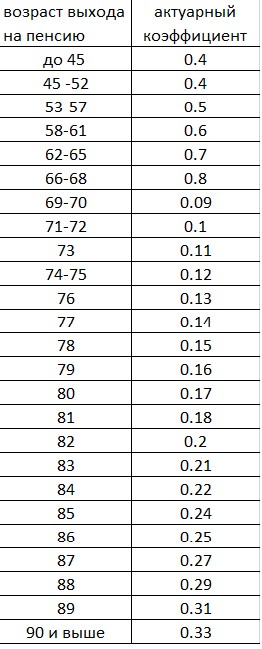

P = BCh+SP1+SP2 where BCh is the basic pension; SP1 – first insurance portion; SP2 – second insurance portion. We also mentioned that basic pension today is 1,780 soms and to earn it in full men have to work (legally) for 25 years, and women – for 20 years. Important note: military service and full-time study at universities and colleges are also counted as the years of employment. If an employee’s total length of employment is below the required value, the size of the basic portion will decrease proportionally to this amount. For details see How Pension System Works in Kyrgyzstan First insurance portion of pension. This component applies to people who had worked until 1996. This is due to the fact that in July 1997 sovereign Kyrgyzstan for the first time introduced the pension reform, which contained the three-component pension system. The law implementation started back in February 1996. According to estimates, the first insurance portion will no longer exist by 2030 because by that time there would be no more working-age people, who had worked until 1996, and the pension would consist of two components only: basic and second insurance portions. To earn the first insurance portion, a pensioner chooses the continuous five-year employment until 1996 with the biggest wage, and submits an income certificate for the given period to the Social Fund. The five-year period should not necessarily begin since the start of the year, it can begin from mid-year or end of year. For example, from June 25, 1975 to June 25, 1980. The point is that the wage in this period must be the highest of the total length of employment until 1996. This is what influences the amount of the first insurance portion of pension. Social Fund multiplies the average wage in the given period by the total length of employment until 1996, and these years turn into percentage. As a result, we receive the amount of the second insurance portion. Here is a formula for calculating the first insurance portion: SP1 = S*Z SP1 – first insurance portion; S – total length of employment until 1996 (important note: here 1 year turns into 1 per cent); Z – monthly average wage until 1996. For example, your total length of employment until 1996 is 10 years. Out of which, the maximum monthly wage in a five-year period (from May 1, 1970 to May 1, 1975) was 150 roubles (based on various sources, the average monthly wage in the Soviet Union was 150 roubles). Roubles are converted into soms by dividing them by 200, i.e.: 150:200 =0.75 Next, we multiply this sum by 12 months to calculate how much you earned in average in one (1975) year. 0.75*12 = 9 Thus, we have income of 9 soms in 1975. Next, we act on the basis of law “On wage correction factors for pension calculations.” This law was adopted to increase the amount of SP1 due to the increase in the average wage across the country. The supervisory board has prepared a special table of correction factors. Every year has its own factor. In 1975 the correction factor is 3,478 soms. The following correction factors have been specified for calculation of the first insurance portion of pension: 1975 and earlier – 3,748.3 1976 – 3,707.7; 1977 – 3,626.2; 1978 – 3,561.8; 1979 – 3,504.3; 1980 – 3,387; 1981 – 3,332; 1982 – 3,269.9; 1983 – 3,212.5; 1984 – 3,155; 1985 – 3,095.2; 1986 – 3,037.9; 1987 – 2,920.6; 1988 – 2,746.1; 1989 – 2,511.7; 1990 – 2,346.6; 1991 – 1,518.9; 1992 – 217.6; 1993 – 31.0; 1994 – 9.6; 1995 – 7.2. As we mentioned before, annual income would be 9 soms if the monthly wage was 150 roubles. Let’s multiply this figure by the correction factor and divide by 12 (number of months). The correction factor in 1975 is 3,748. 9*3,748:12=2,811 Thus, we have monthly average income for 1975 amounting to 2,811 soms. Now, let’s get back to the formula of SP1 calculation. SP1 = S*Z Your monthly income in the amount of 2,811 soms will be multiplied by 10 per cent (as mentioned before, 10 years of employment turn into 10 per cent). 2,811*10%= 281.1 As a result, if a monthly wage was 150 roubles and total years of employment was 10 years, the amount of the first insurance portion will be 281 soms. If an applicant for pension had worked less than 5 years, their average wage would be calculated by dividing the total payroll for this period by the number of months worked. Sometimes a pensioner cannot provide an income certificate because the enterprise where they worked ceased to exist with the collapse of the USSR, yet their employment record book contains relevant records. Say, a pensioner has 20 years of employment until 1996. In this case, according to the Pension Department of the district office of Social Fund, a pensioner should write a request to calculate the amount of the first insurance portion based on the minimum wage in the amount of 1,662 soms. We’ll multiply this amount by 20 per cent (because the period of employment is 20 years): 1,662*20%= 332 This is the amount of the first insurance portion, 332 soms. Second insurance portion of pension The amount of the second insurance portion is calculated by the following formula: SP2 = V*K SP2 – amount of the second insurance portion; V – amount of accumulated insurance contributions per monthly pay (V:12 months) K – actuarial factor What is an actuarial factor? According to the law “On state pension social insurance,” every year the supervisory board responsible for state social insurance management requests demographic data regarding the average life expectancy for men and women for the last five years from the National Statistical Committee. Based on these data, it calculates, estimates and approves the actuarial factor size. The older the person, the higher actuarial factor and the higher SP2 they have and vice versa. Young people have lower actuarial factor, and fewer savings in the second insurance portion. Given that the actuarial factor is the ratio between the full cycle of payments (taken as 1) and the difference between the average life expectancy and retirement age, we have the following formula: K = 1/(SPJ-VVP) K – actuarial factor SPJ – average life expectancy VVP – retirement age The retirement age is 63 for men, 58 for women. Also, the law “On state pension social insurance” provides for benefits for certain groups of people. (More details to follow in another material to be prepared later.) The average life expectancy in Kyrgyzstan, according to the National Statistical Committee, is 71.1 years: 67.2 for men, 75.4 for women. Say, a woman goes on pension at the age of 58.

1/(70-58)= 0.08%

In this case, her actuarial factor will be 0.8 per cent.

The actuarial factor for men will be:

1/(70-63)= 1.14%

Say, a woman goes on pension at the age of 58.

1/(70-58)= 0.08%

In this case, her actuarial factor will be 0.8 per cent.

The actuarial factor for men will be:

1/(70-63)= 1.14%

The actuarial factor will be equal to 1.14 per cent, as in the formula, only if a man reaches the age of 77, which is statistically impossible because the majority of men don’t reach this age.

It’s important to note here that art. 22, law “On state pension social insurance”, sets forth that the actuarial factor is determined by the supervisory board responsible for state social insurance management. The board does not follow this formula and despite the difference in the life expectancy for men and for women, the actuarial factor is the same for both sexes. The actuarial factor will be equal to 1.14 per cent, as in the formula, only if a man reaches the age of 77, which is statistically impossible because the majority of men don’t reach this age. In this case, we see a kind of unfair treatment of the stronger sex because their endowment period is short, and the retirement age is high. Below is the table of actuarial factor approved by the supervisory board for 2017:

To calculate the amount of the second insurance portion, the following formula should be used:

SP2 = V*K

where V is the amount of accumulated insurance contributions per monthly pay (V:12 months)

For example, a young employee (aged 18-45) has earned 15 thousand soms per month, which is an average wage in the Kyrgyz Republic, according to the National Statistical Committee. The amount equal to one-fifth (20 per cent) of the wage is transferred to the Social Fund account as pension contribution, i.e. nearly 3,000 soms. 3,000 soms are calculated per monthly pay, i.e. divided by 12 and multiplied by the actuarial factor:

3,000/12*0.04=10

Thus, a young man saves 10 soms per month as his second insurance portion of his future pension. If his wage doesn’t change for a year, the second insurance portion will be 120 soms for one year, and 1,200 soms for 10 years, respectively. The amount of the second insurance portion increases along with the age. For example, a man aged 55 has a wage of 15,000 soms. The actuarial factor for him will be 0.05 per cent, instead of 0.04.

3,000/12*0.05= 12.5

That is, the second insurance portion of a 55-year old employee is 2.5 soms higher with the wage of 15 thousand soms.

If you need more information about your personal insurance account, please refer to the district office of Social Fund with your ID card.

How to calculate pension contributions

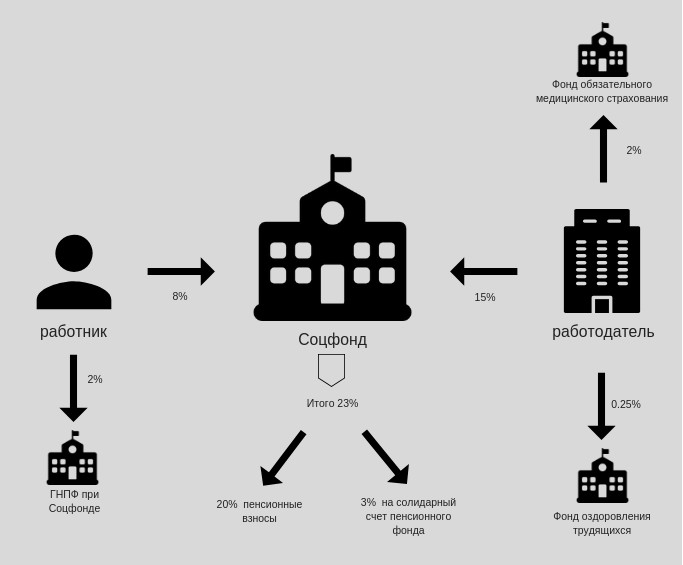

As we have mentioned above, the amount of pension contributions to Social Fund is equal to 20 per cent of a monthly wage. Why 20 per cent?

8 per cent is deducted from the employee’s wage as a pension contribution, 2 per cent go to the State Pension Savings Fund (GNPF). (More details about GNPF to follow in another material to be prepared later.) The employer also pays for their employee: 15 per cent as a pension contribution, 0.25 per cent to the Employee Health Care Fund (FOT), and 2 per cent to the Compulsory Medical Insurance Fund (FOMS). Thus, total contributions of employee and employer to Social Fund amount to 23 per cent, 3 per cent of which will be sent to the pay-as-you-go system, and 20 per cent will be used as pension contributions that affect the second insurance portion. As a reminder, there are disability pensions, and survivor pensions. The pay-as-you-go portion of the pension (3 per cent) is intended for such pensions.

To calculate the amount of the second insurance portion, the following formula should be used:

SP2 = V*K

where V is the amount of accumulated insurance contributions per monthly pay (V:12 months)

For example, a young employee (aged 18-45) has earned 15 thousand soms per month, which is an average wage in the Kyrgyz Republic, according to the National Statistical Committee. The amount equal to one-fifth (20 per cent) of the wage is transferred to the Social Fund account as pension contribution, i.e. nearly 3,000 soms. 3,000 soms are calculated per monthly pay, i.e. divided by 12 and multiplied by the actuarial factor:

3,000/12*0.04=10

Thus, a young man saves 10 soms per month as his second insurance portion of his future pension. If his wage doesn’t change for a year, the second insurance portion will be 120 soms for one year, and 1,200 soms for 10 years, respectively. The amount of the second insurance portion increases along with the age. For example, a man aged 55 has a wage of 15,000 soms. The actuarial factor for him will be 0.05 per cent, instead of 0.04.

3,000/12*0.05= 12.5

That is, the second insurance portion of a 55-year old employee is 2.5 soms higher with the wage of 15 thousand soms.

If you need more information about your personal insurance account, please refer to the district office of Social Fund with your ID card.

How to calculate pension contributions

As we have mentioned above, the amount of pension contributions to Social Fund is equal to 20 per cent of a monthly wage. Why 20 per cent?

8 per cent is deducted from the employee’s wage as a pension contribution, 2 per cent go to the State Pension Savings Fund (GNPF). (More details about GNPF to follow in another material to be prepared later.) The employer also pays for their employee: 15 per cent as a pension contribution, 0.25 per cent to the Employee Health Care Fund (FOT), and 2 per cent to the Compulsory Medical Insurance Fund (FOMS). Thus, total contributions of employee and employer to Social Fund amount to 23 per cent, 3 per cent of which will be sent to the pay-as-you-go system, and 20 per cent will be used as pension contributions that affect the second insurance portion. As a reminder, there are disability pensions, and survivor pensions. The pay-as-you-go portion of the pension (3 per cent) is intended for such pensions.

In this material, we have shown in detail how to calculate first and second insurance portions of pension. Our next material will cover two-per-cent contributions that are transferred on a monthly basis to the Social Fund’s State Pension Savings Fund.

Asel Sooronbaeva – CABAR.asia School of analytic journalism alumnus

In this material, we have shown in detail how to calculate first and second insurance portions of pension. Our next material will cover two-per-cent contributions that are transferred on a monthly basis to the Social Fund’s State Pension Savings Fund.

Asel Sooronbaeva – CABAR.asia School of analytic journalism alumnus

This article was prepared as part of the Giving Voice, Driving Change – from the Borderland to the Steppes Project implemented with the financial support of the Foreign Ministry of Norway.